The occurrence of the 2020 pandemic changed a lot of things in our social-economic society and triggered many subsequent events to happen. Such changes warranted substantial research into what is going on right before our eyes as well as what is happening behind the scenes. The following list of the "10 Reasons to Buy Silver in 2020" is a result of at least 100 hours of research. The following research and conclusions could make a huge difference in the financial state of those that decide to follow along. So here are the reasons, in reverse order…

#10) Low Interest Rates – In June of 2020, moneyandmarkets.com predicted that the lowering of interest rates would push the price of gold into record territory with respect to US dollars. On July 29th, their prediction came true. “Mathematically, keeping rates near zero means we will have negative real interest rates (interest rate minus inflation),” [Brian] Christopher [Banyan Hill Publishing] wrote via email. “Gold thrives in a world of negative real interest rates. Today, there are fewer reasons not to own assets that don’t pay interest…”

And silver should and has been following suit and increasing at a significantly higher rate than Gold.

Article: moneyandmarkets.com

#9) Record Delivery in July – In regards to the “paper trading” of silver on the comex, most purchasers purchase the right to have the silver delivered (“physical silver”), but they usually just sell the right to someone else. This matter is discussed more on reason #4. Institutions are apparently getting antsy and realize they need to have the real stuff on hand. The record volume of delivery requests in July is a big trigger for great things to come.

Video: Arcadia Economics (First 7:07)

#8) Stimulus Packages as a Response to the Pandemic – Most people can comprehend that if the government “prints more money,” this will cause significant inflation. The threat of inflation drives people towards the precious metals. The stimulus packages coming from the US Government “stimulated” us to consider gold and silver as a hedge against inflation. Upon doing thorough research regarding what has been happening with Silver and where changes in the economy are heading, the conclusion is that it is actually a phenomenal investment to jump into in 2020.

#7) Technical Analysis (Gold/Silver Ratio) – This is my personal area of expertise. The long-range charts show that silver has recently entered a bull market that should last a handful of years. The numbers here are enough to support that Silver should sustain at least double-digit returns for the next few years making it a viable investment to strongly consider. The Cup and Handle pattern anticipated a target of $26 upon breaking $21. We thought it might take a couple months or a couple weeks, but amazingly it took just a few days! This coincided with the record delivery event discussed in reason #8.

Along with the silver price charts, the Gold/Silver Ratio (GSR) needs to be analyzed as well. GSR tells us how many ounces of silver it takes to buy one ounce of gold. During the “Covid Crash” in March, the GSR spiked from the 90’s to over 122 – which is way out of whack! Even the value of 90 was extremely high and warrants a correction. The correction started in July of 2020. Typical GRS values over the past 2 decades have been in the 50 to 60 range.

According to Article: goldsilver.com , “When the ratio has topped 80, it has signaled a time when silver was relatively inexpensive relative to gold. Silver went on to rally 40%, 300%, and 400% the last three times this happened.” Averaging those increases projects a 250% return this next year! When Gold and Silver hit monumental prices in 2011, the GSR came down all the way to 32. Holding that same ratio with Gold now just over $2,000, silver should be trading at over $60 an ounce, not sub $30!

Centuries ago, the GSR was much smaller. Article:investopedia.com states: "For hundreds of years prior to that time, the ratio, often set by governments for purposes of monetary stability, was fairly steady, ranging between 12:1 and 15:1. The Roman Empire officially set the ratio at 12:1, and the U.S. government fixed the ratio at 15:1 with the Mint Act of 1792... President Roosevelt set the price of gold at $35 an ounce in 1934...For the whole of the 20th century, the average gold-silver ratio was 47:1... Some analysts point to the 20th century average ratio of 47:1, while others argue that a new, higher average ratio level has been established since the millennium. Other analysts continue to argue that the ratio should eventually return to much lower levels, around 17:1 to 20:1."

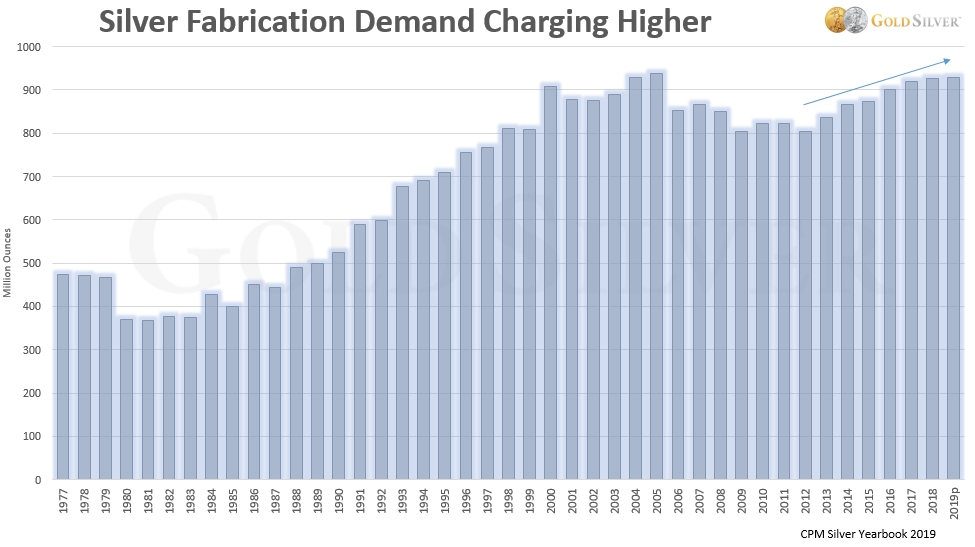

#6) Demand – Gold has always been considered the primary investment metal. Silver has recently been discounted to some degree as an investment metal as technology advancements have “declared” it to be “strategic commodity” since it has become more and more a metal used in industry. With silver being an important ingredient in 21st century devices such as cell phones, computers, electric cars and solar panels, this should have been increasing the value of Silver, much more so than that of gold. The chart below depicts the annual increase in overall demand over the last 7 years, increasing each year and approaching an all-time high.

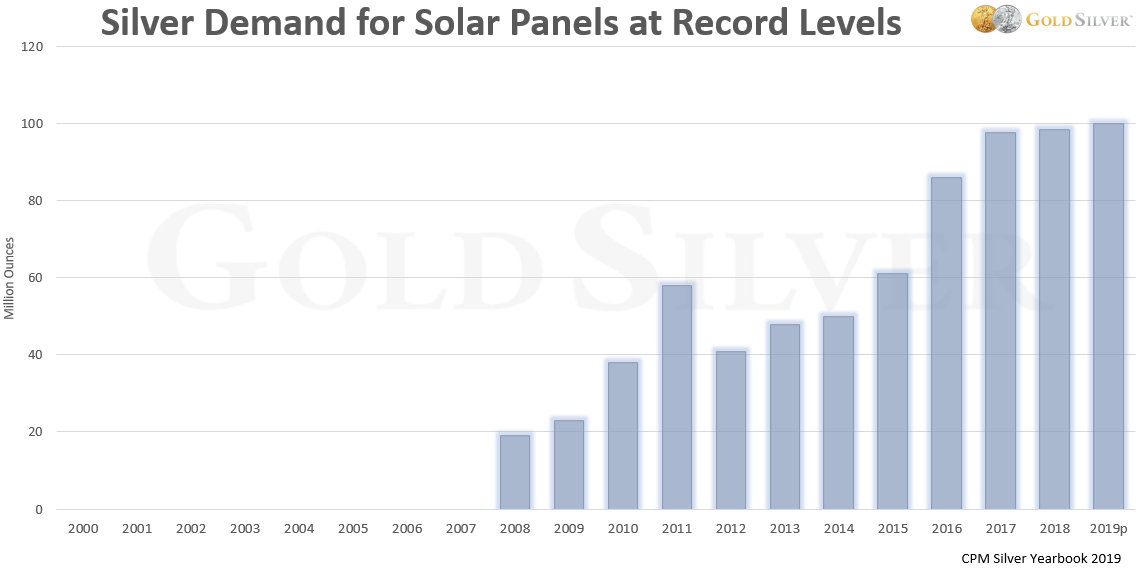

As demonstrated below, solar panels are one of the biggest reasons for such increase in demand.

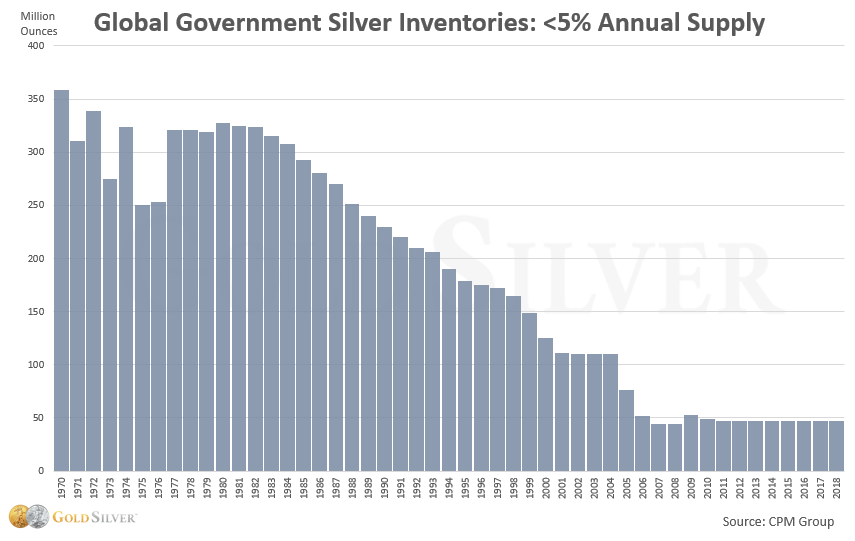

#5) Supply – The complementary companion of "Demand" is probably a more powerful component on the pending rise in silver’s value. This component has two facets. The first is inventory supply. The global government stockpiling inventory is very low. The amount during the last decade is less than 5% of the annual supply. This is about one fourth of the inventory during the 70’s and 80’s.

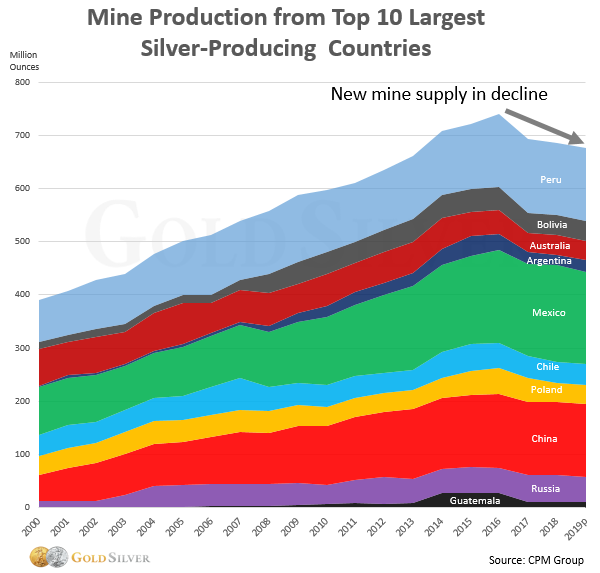

To magnify the impact of supply being a major factor, consider the mining production situation. The production of usable silver has been in a state of decrease the past 5 years as shown below.

The chart above does not include 2020. When the pandemic hit in March, many mines were forced to shut down or functioned at less than full capacity. When the lockdown hit and the supply was put in jeopardy, the price of silver actually plummeted. This is counter-intuitive and is a major flag that something is not quite right! Obvious to most economists, this does not make sense. The forces behind this economical anomaly are discussed in reason #2.

Keith Neumeyer, CEO of First Majestic Silver, states that the gold to silver mining ratio is only 1 to 8. He thus purports that the GSR should be closer to 8 or 10. That would push silver to over $200 an ounce here in August, 2020 and he speculates $300 an ounce in a few years. Video: Keith Neumeyer (3:00 to 7:10)

The dynamic duo of decreasing supply and increasing demand should be having a double whammy effect on the price of silver in the pending years.

#4) COMEX Corruption: Potential Unraveling – What is the COMEX? The COMEX (formerly known as the Commodity Exchange, Inc.) is the primary futures and options institution for trading of metals. It is not a free-market system that does seem to be infiltrated with manipulation and corruption.

Imagine you are playing musical chairs with hundreds or thousands of others. However, 80-90% of the chairs are actually holograms. When the music stops and you think you have a chair to sit in, your attempt to do so just allows gravity to pull you all the way to the floor! That is potentially what is wrong with the game that the comex is playing. They are trading contracts to own gold and silver and potentially have the tangible goods delivered, but rarely do buyers do so. Buyers usually just sell the right to someone else, who in turn sells it to someone else…

Apparently, there are more contracts out their being trade than there is actual silver that could be delivered. Many times more! How much more is uncertain, but it is apparently MASSIVE! When the “secret” gets out and the music stops, we will have many musical chairs players fighting for just a few non-hologram chairs, and paying a pretty price for them.

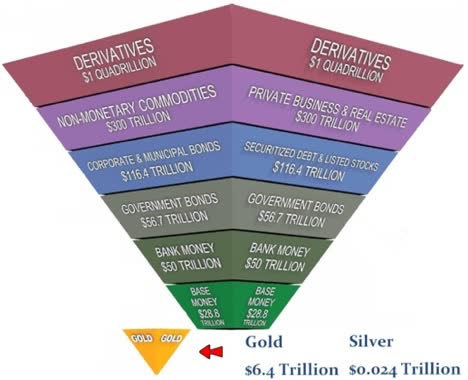

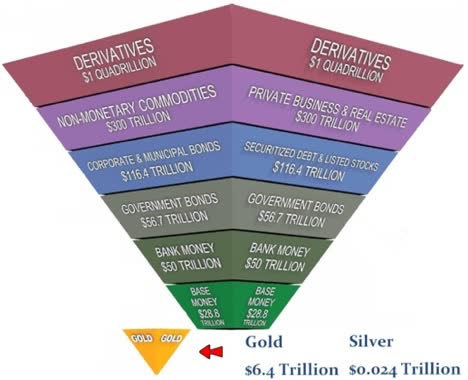

#3) Silver’s Current Volume of Worldwide Wealth – In his lecture in 2019, Jeff Clark of goldsilver.com points out that the current percent of world-wide wealth delegated to silver is extremely minuscule in the inverted wealth pyramid below.

|

In this video of the lecture (first 10 minutes), he concludes that a transfer of just a small fraction of the value from any of the other areas into silver would cause silver to jump by incredible leaps and bounds. The other nine reasons help promote what the true value of silver may be. When others see that value, significant transfers could easily take place, and take place rapidly. In Jeff’s opinion, this is the number one reason why silver prices will soar someday. We, however, are looking why you should buy silver specifically in 2020. The principle in Jeff's paradigm has been true for many years, and will be the case until those potential transfers takes place. This may be years away. This fact gives silver incredible potential, but is not necessarily the best reason why 2020 is the year to jump on in. Thus it is very high on our list, but only #3.

#2) JP Morgan: Manipulation is Dissolving – So if silver is supposed to be so valuable and should be trading at values several times higher than it is, there must be a reason for it to be trading so low. Well, here it is. There appears to be a ton of mischievous activity going out there, and JP Morgan is the biggest culprit as they have been manipulating the market. How they have been doing it relates to the Comex and the corruption within that institution. Late last year, several JP Morgan metals traders have been caught manipulating the market, or unofficially referred to as “spoofing.” Video: They have been in cahoots with several other major banks and are charged with Racketeering.

The process they were using was shorting the market to drive down the price, as they had more power than they should. The word on the street is that they are in negotiations with the DOJ and they have been “strongly encouraged” to not engage in such activity as to alleviate the sentence they should be facing. Amazingly, this summer the occasional massive, unwarranted shorting that usually occurred had evaporated. So it looks like the actual force holding down the price of silver has been dissolved! In the 3 week period starting July 21st of 2020, silver has surged approximately 50%.

Normally, one might think that it is time to jump out because of this extreme run up. But the other nine reasons in this list help justify a much higher target, hopefully in the near future. In 2010/2011, silver nearly tripled in just a few months, starting at $18 and ending up near $50. Then amazingly, massive shorting began. So the indication that there is no longer the major shorting mechanism that has squashed the price for the past near-decade gives us confidence that this time silver will keep on going towards what it’s true value should be! This 3 week period should be a signal to what is to come rather than the final destination.

#1) Gold/Silver Standard Return has Begun – In 1971, the US dollar was taken off the Gold Standard and transitioned to a fiat money system.

Definition: “Fiat money is a government-issued currency that isn't backed by a commodity such as gold. Fiat money gives central banks (the Fed) greater control over the economy because they can control how much money is printed”.

This caused a financial fiasco at the time. On top of that, as we became too accustom to the change, many were not totally aware of the long-term dangers. Fiat currency systems eventually fail.

The mindset of the current US administration is shifting back towards the gold standard. Current Fed nominee Judy Shelton is a hard-core gold standard advocate. This article coincides with the June 21st date that triggered the 50% run up in 3 weeks’ time. Coincidence? Probably not! Returning to such standard will propel the price of gold upward at a significant pace, and its little brother, silver, should outpace gold in that same direction. The start of this shift is our #1 reason why you should buy silver in 2020!

Conclusion: Each reason above is enough to warrant considering silver as an investment with double digit returns. We don’t just have a “Perfect Triple Storm” but we have a “Deca-Storm” that has formed here in 2020. Thus we are expecting silver to head towards, and hopefully eclipse the triple digit mark in the very near future.